The Banking, Financial Services, and Insurance (BFSI) sector is a cornerstone of the global economy, facilitating financial transactions, risk management, and wealth generation. However, it faces challenges from rapid advancements in information and communications technology, evolving regulatory landscapes, and shifting consumer expectations.

To remain competitive, BFSI entities must innovate, with Business Process Outsourcing (BPO) playing a crucial role in enhancing service delivery, ensuring compliance, and adapting to market changes. This whitepaper explores the transformative impact of BPO on BFSI operations, underscoring the benefits, challenges, and best practices of outsourcing.

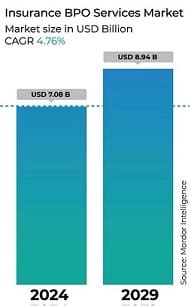

With a projected CAGR of 9.1%, the global BPO service market for BFSI is expanding rapidly and expected to reach $147.9 billion by 2028 (Research and Markets). Major growth drivers include the increasing demand for cloud-based and mobile-enabled BPO services, the rising popularity of digital banking, and increasing adoption of robotics process automation to automate routine and predictable processes. For the insurance industry alone, the global BPO service market is currently estimated at $7.08 billion with a CAGR of 4.76%, putting it on track to reach $8.94 billion by 2029 (Mordor).

Benefits from BPO Services

Outsourcing empowers BFSI firms to streamline operations, focus on core competencies, reduce risks, and accelerate digital transformation.

- Cost Efficiency: Cost reduction is a primary incentive for BPO adoption. Over half of financial services businesses that outsource (59%) report cost savings as the main motivation (Deloitte). By delegating tasks such as data entry and customer support to BPO partners, BFSI firms can reduce labor and infrastructure costs, benefiting from the economies of scale and expertise of these providers.

- Operational Excellence: BPO services facilitate optimized operations and process efficiency. BFSI firms can leverage industry best practices, cutting-edge technologies, and global delivery models to enhance productivity, minimize errors, and increase agility. Notably, 63% of businesses acknowledge access to technology and expertise as a significant advantage of outsourcing (Accenture).

- Customer Experience: A single negative experience can cause 17% of customers to leave a brand they once favored – escalating rapidly to 59% after multiple experiences (PwC). By outsourcing customer experience functions, BPO providers can elevate service quality and responsiveness, leading to improved satisfaction and loyalty.

- Scalability and Flexibility: BPO offers scalable solutions that enable BFSI firms to adapt their operations to market dynamics without substantial investments or long-term commitments. This is crucial for handling fluctuating demand and growth.

- Addressing Information and Communication Technology Challenges: Specialized IT services assist BFSI firms in staying technologically advanced. BPO providers offer software development, system integration, and IT support solutions, allowing BFSI organizations to embrace new technologies without continuous internal investment – reducing costs even while enhancing efficiency and agility.

- Risk Management: The specialized skills and technologies of BPO partners support BFSI firms in risk mitigation and compliance assurance. Adherence to security protocols and standards provides safeguards against financial crimes and data breaches, bolstering risk management and business continuity.

- Navigating Regulatory Changes: BPO professionals specializing in regulatory compliance often deliver services such as compliance monitoring, reporting, and risk management, ensuring conformity with laws and standards and diminishing the risks of non-compliance.

Challenges and Considerations

While the advantages of BPO services for the BFSI sector are significant, it is essential to acknowledge the accompanying challenges.

Challenge | Rationale/Explanation |

|---|---|

Data Security and Privacy | As BFSI organizations handle sensitive customer data and confidential financial information, data security and privacy are paramount when outsourcing critical functions like data processing, transaction processing, and fraud detection. BFSI firms must select BPO providers that adhere to stringent security protocols, encryption standards, and data privacy regulations to safeguard data against unauthorized access and breaches. |

Regulatory Compliance | The BFSI sector – which primarily includes commercial banks, investment banks, brokerage firms, credit unions, savings and loan associations, asset management companies, and insurance providers – is heavily regulated. When outsourcing functions such as compliance monitoring, risk management, and reporting, BFSI firms must ensure that their BPO providers are proficient in the relevant regulations, compliance requirements, and industry standards to mitigate risk and maintain alignment. |

Technology Integration and Interoperability | Integrating outsourced functions with existing systems, platforms, and workflows can be intricate. Robust integration strategies, data migration tools, and APIs are necessary to ensure seamless interoperability between in-house systems and those provided by BPO providers. Data governance agreements should also be in place to facilitate data exchange and foster collaboration and transparency across organizational boundaries. |

Vendor Selection and Due Diligence | Selecting the appropriate BPO partner is vital for successful outsourcing. BFSI firms should conduct thorough due diligence and vendor selection processes, evaluating the reputation, capabilities, track record, and financial stability of potential BPO providers. Additionally, they should establish clear SLAs, performance metrics, and risk mitigation strategies to set expectations and guarantee service quality and accountability. |

Best Practices in Successful Implementation

For fruitful BPO partnerships, BFSI firms should pursue the following best practices.

- Clearly Define Objectives and Requirements: Determine the specific functions or processes to outsource, with clear desired outcomes and key performance indicators established beforehand. Involvement of key stakeholders – including business leaders, department heads, and frontline staff – is crucial for securing alignment, buy-in, and ownership.

- Conduct Rigorous Due Diligence: Assess BPO providers based on their expertise, experience, capabilities, financial health, security protocols, and regulatory compliance. Examine client references and third-party evaluations to validate claims, gauge reputation, and confirm credentials.

- Establish Robust Governance and Oversight: Define roles, responsibilities, and escalation processes clearly, and conduct regular performance reviews, audits, and risk assessments to ensure compliance and accountability. Appointing dedicated relationship managers, service delivery managers, and escalation contacts can aid in communication, problem resolution, and ongoing enhancement.

- Invest in Technology and Infrastructure: Implement strong data security measures, encryption protocols, and access controls to protect sensitive data. Integrated systems, collaborative tools, and workflow automation solutions will support communication, boost productivity, and enable smooth integration with BPO partners. Provide necessary training, education, and support to BPO teams to acquaint them with internal systems, processes, and policies.

- Foster Collaboration and Knowledge Management: Regular meetings and training sessions are beneficial for promoting collaboration, addressing issues, and aligning strategies. Encourage feedback and knowledge-sharing to improve performance and service delivery.

Takeaways

- Business Process Outsourcing (BPO) services have become a catalyst for enhancing efficiency, agility, and competitiveness for BFSI organizations.

- BPO services enable BFSI organizations to achieve cost efficiency, optimized operations, scalability, flexibility, risk management, compliance, and an improved customer experience.

- Challenges in data security, regulatory compliance, and technology integration inherent to BPO can be successfully addressed through meticulous planning and execution.

- BFSI organizations that cultivate a robust partnership with their BPO providers can fully realize the benefits of their outsourcing endeavors, positioning themselves for sustained success and growth.

About the Company:

Accelergent Growth Solutions provides expert business process management and outsourcing, automation, technology, customer service, and marketing services to the benefits, banking, financial services, and insurance industries.